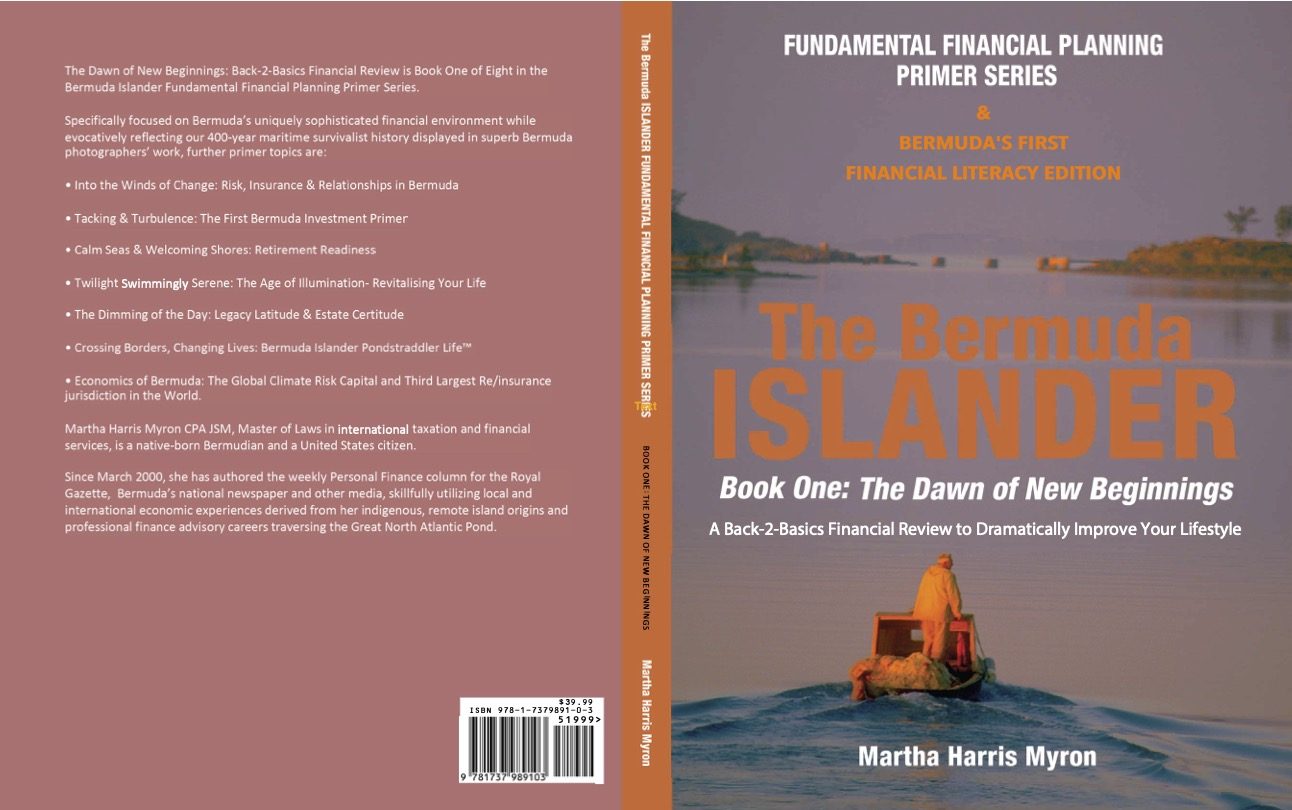

Bermuda’s First Financial Literacy Primer

Originally published in paperback 8.5in X11in, the book - all 298 pages - is available here in Steps for free in PDF format.

Preview & Mission Statement by author, Martha Harris Myron

Welcome

to The Bermuda Islander Fundamental Financial Planning Primer Series, a much- needed comprehensive guide published in digital pdf format, written about Bermuda’s financial environment specifically for Bermudians, Bermuda residents and expatriate guest workers, living and working in our Bermuda’s international financial environment.

Designed to start with Series One - Your Back-2-Basics Personal Financial Review, the Series builds upon the basic platform first, then, is followed by further components of financial planning in seven more print & digital Books to fully arrive at a comprehensive understanding of all things financial in Bermuda.

Please see introduction below for full details on Series One through Eight.

Any proceeds earned from the BIFFPP Series in print available on Amazon - will be donated to the Bermuda Salvation Army in memory of our mother, Clarine Harris and our father, Cecil E Harris, the Sewing Machine Man of Wesley Street, Hamilton, Bermuda.

The Book in digital PDF format is free to download.

As a long-term (February 2000) financial columnist for the Royal Gazette, Bermuda, and numerous other Bermuda and international publications, it is my hope that this series will provide relevant useful, financial information to help Bermuda Islanders understand the complexity of the relationships between their domestic financial interests and their international connections to better manage their finances.

Why would I do this?

Background. Bermuda and our people possess a proud and unique history. For more than four hundred years, Bermuda and our people have commanded a strong, viable position in global trade, inconceivably inversely proportionate to our tiny island and small population.

From the arrival of our first shipwrecked sailors, Bermudians have always lived in an open society with fiercely independent survivalist instincts.

Never much constrained by physical frontiers, as well as possibly to relieve the restrictions of life contained within 21 square miles, Bermudians have acquired legendary reputations as some of the world’s foremost mariners, traders, and explorers.

Our forebears, in 1610, delivered the US Jamestown settlement from starvation in the Bermuda-built HMS Deliverance (from scavenged nautical wreckage and native cedar); have joined just causes (and other countries’ armies), with some fighting the ultimate battle for world peace, liberty and justice for all. Families have emigrated to far off nations, assimilating new cultures and relationships in the quest for commerce and discovery.

Centuries, generations, and decades later they have returned to Bermuda bringing with them the trappings of international living, cosmopolitan thought, multiple extended family nationalities, while possessing assets and conducting business in other jurisdictions.

This Global mobility (rock fever) of our people is indicative of the reality that every country and its residents now live in a time of constant change: people, money, goods, intellectual property, innovation, and ideas literally encompassing, circumventing the earth in continuous movement.

In tandem with these migrations, Bermuda, our country, transformed itself from a relatively simple cash society (fishing village style) where everything moved slower; where business was conducted on a trusted handshake and a cash- count-those-bills deposits and bill payment structures; where the economy was closed - operating in a comfortable, stable, unexciting financial environment.

Bermuda’s People are a microcosmic polyglot of nationalities, races, languages, religions, and cultures all derived from various origins from immigrating, emigrating across the globe to and from Bermuda. Some arrived involuntarily as slaves, and indentured servants. Others were merchant seamen, share-holders, governing bodies, politicians, and freemen settlers.

Among the most influential familial and business connections are the United States, United Kingdom, Canada, Azores (Portugal), Ireland, Europe, Australia, New Zealand, and the Caribbean: Barbados, Turks & Caicos, Jamaica, Trinidad & Tobago, St. Kitts & Nevis, Anguilla, Barbuda, Tortola, and others related.

This plethora of international personalities, businesses, countries of origin, residency, domicile, immigration rights, and taxation assertions presents enormous complexity in the financial lives of every-day Bermuda residents.

Keeping up with these changes is a tremendous challenge for individuals across the Bermuda spectrum, particularly in today’s 24/7 business environment, when most people’s first focus is on work, family life, faith, and community.

Just as our ancestral seafarers derived their origins from many domiciles, locally, it is highly probable (and often verifiable) that the majority of Bermuda residents:

- possess more than one passport;

- own assets in various other jurisdictions;

- embrace more than one culture;

- speak more than one language;

- be related to citizens of other countries;

- have relatives, responsibilities, and connections to more than one jurisdiction;

- be employed in more than one jurisdiction, and

- have both foreign and domestic beneficiaries.

Further, Bermuda’s good fortune is that Bermuda’s international finance centre today is a financially sophisticated, dominant force in the global marketplace of insurance, reinsurance, investments, banking, trust administration, fintech, marine and aviation commerce.

It is endemic of this environment (and the clients that we serve) that local financial institutions routinely offer money market funds in more than nine major currencies, while foreign currency exchanges take place in a matter of minutes electronically or at a local bank teller window.

But what of the ordinary resident of Bermuda, whether well-off, or not-so-financially successful?

More and more responsibility for our own future financial security is being placed squarely on our shoulders.

We are overwhelmed with financial data. Electronic media have plugged us into the 24/7 global arena, a complex and ever evolving world.

We are working harder and longer than ever before.

• We know we need to pay attention to our finances, but when we are really stressed, it is far easier to plan for a great vacation.

• With the constant pressure of spiralling living and housing costs, Bermudians and expatriate residents alike face a bewildering, daunting array of financial choices for managing their family budgets.

Why are term deposits so low?

How can we manage the ever-increasing cost of living here?

Health care affordability is an increasing concern to us.

What type of investments and in which currencies are most suitable for us?

Have I made the right choices for my pension?

How much education funding is needed for our children when they have to leave the island for university abroad?

How much will I need to retire; when should I retire: and should I relocate?

What are the ramifications of losing my job?

How can we ever manage not making our mortgage payments? Will we lose our home?

I’m a dual-citizen of Bermuda and another country - what are we going to do about estate planning for our multi-national family?

Our children are living in multiple jurisdictions - should we consider relocating, and what citizenship will be our primary?

Financial complexity and difficulty in finding in-formation relevant to our Bermuda economic environment abounds. It can be far more challenging than any homework.

But, it shouldn’t be.

Why the focus on financial Knowledge?

The level of your future financial success is directly related to the level of your financial knowledge

Becoming financially savvy is having the courage to understand and control your entire financial environment by,

- Developing a personal financial mission statement for personal success

- Branding yourself to move up the career ladder

- Managing your cash, both income and expenses

- Accumulating assets by appreciating your net worth and decreasing your good debts

- Utilising all employee benefits offered to you in real money terms

- Investing in yourself and your children with continuing education

- Preparing for all contingencies with risk management protection, insurance, and prudent risk decisions

- Learning about Investments available in our complex international environment

- Understanding your financial behaviour and working on positive modifications

- Choosing a qualified experienced financial advisor, or do-it-yourself investor

- Living and adapting to Bermuda’s AA+ economy – an expensive place to live, work, and retire

- Refining lifestyle changes: relocation, revitalisation, retirement, investment asset allocation, annuities, drawdown risk and monitoring your pension contributions.

- Minimising domestic and international tax issues

- Wending your expatriate resident / Bermudian international connections through the off-shore/onshore financial and cross borders’ mazes

- Coping and managing the human element: the effect of finances on relationships, careers, and serious life events

- Organising your ultimate passing: When you die and the role of estate planning, trusts, business succession, stamp duty, and multiple jurisdictional oversights.

Readers, take the challenge - to figure out what you have, what you can do to use your resources to make a personal financial plan that works for you.

This series will help you accomplish your plan.

Sensible, practical, and doable — all designed and engineered for you.

Now it is up to you. “Change your Life for the better.”

Step One:

Building Your Brand

WIP

Comments or Questions? contact@marthaharrismyron.org

©2024 Martha Harris Myron Bermuda PondStraddler Finance Media All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.