Martha Harris Myron

PondStraddler Finance Media Productions

Goldsta-80-Oldsta International Finance Journalist

Originally published in paperback 8.5in X11in, the book - all 298 pages - is available here in Intro + Steps 1- 18 for free download in PDF format.

Welcome

to The Bermuda Islander Fundamental Financial Planning Primer Series, a much- needed comprehensive guide published in digital pdf format, written about Bermuda’s financial environment specifically for Bermudians, Bermuda residents and expatriate guest workers, living and working in our Bermuda’s international financial environment.

Designed to start with Series One - Your Back-2-Basics Personal Financial Review, the Series builds upon the basic platform first, then, is followed by further components of financial planning in seven more print & digital Books to fully arrive at a comprehensive understanding of all things financial in Bermuda.

Please see introduction below for full details on Series One through Eight.

Any proceeds earned from the BIFFPP Series in print available on Amazon - will be donated to the Bermuda Salvation Army in memory of our mother, Clarine Harris and our father, Cecil E Harris, the Sewing Machine Man of Wesley Street, Hamilton, Bermuda.

The Book in digital PDF format is free to download.

As a long-term (February 2000) financial columnist for the Royal Gazette, Bermuda, and numerous other Bermuda and international publications, it is my hope that this series will provide relevant useful, financial information to help Bermuda Islanders understand the complexity of the relationships between their domestic financial interests and their international connections to better manage their finances.

Why would I do this?

Background. Bermuda and our people possess a proud and unique history. For more than four hundred years, Bermuda and our people have commanded a strong, viable position in global trade, inconceivably inversely proportionate to our tiny island and small population.

From the arrival of our first shipwrecked sailors, Bermudians have always lived in an open society with fiercely independent survivalist instincts.

Never much constrained by physical frontiers, as well as possibly to relieve the restrictions of life contained within 21 square miles, Bermudians have acquired legendary reputations as some of the world’s foremost mariners, traders, and explorers.

Our forebears, in 1610, delivered the US Jamestown settlement from starvation in the Bermuda-built HMS Deliverance (from scavenged nautical wreckage and native cedar); have joined just causes (and other countries’ armies), with some fighting the ultimate battle for world peace, liberty and justice for all. Families have emigrated to far off nations, assimilating new cultures and relationships in the quest for commerce and discovery.

Centuries, generations, and decades later they have returned to Bermuda bringing with them the trappings of international living, cosmopolitan thought, multiple extended family nationalities, while possessing assets and conducting business in other jurisdictions.

This Global mobility (rock fever) of our people is indicative of the reality that every country and its residents now live in a time of constant change: people, money, goods, intellectual property, innovation, and ideas literally encompassing, circumventing the earth in continuous movement.

In tandem with these migrations, Bermuda, our country, transformed itself from a relatively simple cash society (fishing village style) where everything moved slower; where business was conducted on a trusted handshake and a cash- count-those-bills deposits and bill payment structures; where the economy was closed - operating in a comfortable, stable, unexciting financial environment.

Bermuda’s People are a microcosmic polyglot of nationalities, races, languages, religions, and cultures all derived from various origins from immigrating, emigrating across the globe to and from Bermuda. Some arrived involuntarily as slaves, and indentured servants. Others were merchant seamen, share-holders, governing bodies, politicians, and freemen settlers.

Among the most influential familial and business connections are the United States, United Kingdom, Canada, Azores (Portugal), Ireland, Europe, Australia, New Zealand, and the Caribbean: Barbados, Turks & Caicos, Jamaica, Trinidad & Tobago, St. Kitts & Nevis, Anguilla, Barbuda, Tortola, and others related.

This plethora of international personalities, businesses, countries of origin, residency, domicile, immigration rights, and taxation assertions presents enormous complexity in the financial lives of every-day Bermuda residents.

Keeping up with these changes is a tremendous challenge for individuals across the Bermuda spectrum, particularly in today’s 24/7 business environment, when most people’s first focus is on work, family life, faith, and community.

Just as our ancestral seafarers derived their origins from many domiciles, locally, it is highly probable (and often verifiable) that the majority of Bermuda residents:

Further, Bermuda’s good fortune is that Bermuda’s international finance centre today is a financially sophisticated, dominant force in the global marketplace of insurance, reinsurance, investments, banking, trust administration, fintech, marine and aviation commerce.

It is endemic of this environment (and the clients that we serve) that local financial institutions routinely offer money market funds in more than nine major currencies, while foreign currency exchanges take place in a matter of minutes electronically or at a local bank teller window.

But what of the ordinary resident of Bermuda, whether well-off, or not-so-financially successful?

More and more responsibility for our own future financial security is being placed squarely on our shoulders.

We are overwhelmed with financial data. Electronic media have plugged us into the 24/7 global arena, a complex and ever evolving world.

We are working harder and longer than ever before.

• We know we need to pay attention to our finances, but when we are really stressed, it is far easier to plan for a great vacation.

• With the constant pressure of spiralling living and housing costs, Bermudians and expatriate residents alike face a bewildering, daunting array of financial choices for managing their family budgets.

Why are term deposits so low?

How can we manage the ever-increasing cost of living here?

Health care affordability is an increasing concern to us.

What type of investments and in which currencies are most suitable for us?

Have I made the right choices for my pension?

How much education funding is needed for our children when they have to leave the island for university abroad?

How much will I need to retire; when should I retire: and should I relocate?

What are the ramifications of losing my job?

How can we ever manage not making our mortgage payments? Will we lose our home?

I’m a dual-citizen of Bermuda and another country - what are we going to do about estate planning for our multi-national family?

Our children are living in multiple jurisdictions - should we consider relocating, and what citizenship will be our primary?

Financial complexity and difficulty in finding in-formation relevant to our Bermuda economic environment abounds. It can be far more challenging than any homework.

But, it shouldn’t be.

Why the focus on financial Knowledge?

The level of your future financial success is directly related to the level of your financial knowledge

Becoming financially savvy is having the courage to understand and control your entire financial environment by,

Readers, take the challenge - to figure out what you have, what you can do to use your resources to make a personal financial plan that works for you.

This series will help you accomplish your plan.

Sensible, practical, and doable — all designed and engineered for you.

Now it is up to you. “Change your Life for the better.”

Welcome to The Bermuda Islander Fundamental Financial Planning Primer Series, a much- needed comprehensive guide to be published in digital format (FlipBook/PDF), written about Bermuda’s financial environment specifically for Bermudians, Bermuda residents and expatriate guest workers, living and working in our Bermuda’s international financial environment.

Designed to start with Series One - Your Back-2-Basics Personal Financial Review, the Series builds upon the basic platform first, then, is followed by further components of financial planning in seven more digital eBooks to fully arrive at a comprehensive understanding of all things financial in Bermuda.

Download to read all!

It used to be called ‘making a

statement’.

Watch anyone today, anywhere, anytime. We all

send subtle (sometimes not so) signals about

what we stand for, what we want, who we think

we are, and where we’d like to be seen in our so-

cial strata. We think that we are completely indi-

vidualistic - choosing to do our own thing – but,

whether making that selective choice to be a lon-

er or star of the evening, we are conforming to a

pattern of expected behaviour.

Download to read all!

Setting motivating goals is easy. Changing old habits is hard.

You will need Motivation

How can you motivate yourself to get going – to

achieve any goal?

Have a reason. What matters MOST TO YOU!

Your goal must something you want to do just

about more than anything else.

• Make it your first priority

• Commit to achieving your goal

• Become relentless and disciplined in that

commitment

• Write your plan down

Yes, life obstacles may slow you down. So, return

to your goal as soon as you can.

Download to read all!

Make No Mistake, It Is a Challenge

Do you want to change?

This is your decision. You may need to modify

your financial behaviour to achieve your goals.

And, that is a very hard thing to do!

Because it means changing what and who you

are now.

Change means taking risks.

Change means you could fail and feel foolish.

Change may mean losing personal relationships –

if you decide to say, cut back on expensive par-

tying nights out, or going on a diet (to save on

groceries), or changing other personal habits that

no longer will match those of your friends, your

significant other, or your family.

Download to read all!

These are the critical components needed to be-

come financially successful.

• Following through on implementing your

personal goals as outlined above.

• Manage (invest) your cash flow and live

within your means.

This is the hardest challenge for most people be-

cause it means delaying gratification. Our society

has culturally conditioned us to want instant hap-

piness, (however temporary).

• Increase knowledge to plan for the future

The compounding effect of relentless knowledge

building upgrades your intellectual skills, brands

and positions you to capitalise on opportunities

in the workplace, harmonises your personal rela-

tionships, and is a sheer catapult to lifelong per-

sonal and financial success.

Download to read all!

Starting Your Budget Plan

Control the Small Stuff Slippage First.

o Budget is to Control Your Money in order to ac-

quire peace of mind (and some luxury).

So Why is it such a challenge working with a

budget?

The word budget has negative connotations for

most people, on a conscious and subconscious

level.

The thought of a developing a budget im-

mediately brings forth visions of constant denial

of what we want, guilt about spending too much,

or represents just one more thing to do at the end

of the day; let’s face the truth, we hate it.

Download to read all!

There are two simple steps to the method of man-

aging your household costs and your budget:

• Monthly (or quarterly) Track Actual income

& expenses, the monetary things that hap-

pen in real life.

• Then, define your budget -

you determine what you would like to receive in income

and what you want to control in allocating

your spending each month. Many of these

are fixed costs: rent/mortgage, utilities,

transportation, school fees. You have to pay

them. However, you are planning ahead as

well for those once-a-year cash hits, vehi-

cle registration, vacation, land tax, house or

tenant insurance, education, etc.

It is very seldom that these two - actual and bud-

geted are the same. Close to - is good enough!

Download to read all

The Deceptively Deceitful Allure of Debt

Debt is easy money. So is a lump sum payment,

upfront cash, easy to justify, easy to spend. Trou-

ble is, what you bought with it, what you used it

for - like propping up the HomeFront Budget - is

not yours, not until you pay the cash back.

Personal debt is a personal burden, almost turning one

into a financial slave. You are not your own complete person when someone, a company, or a government can control your financial dignity and destiny.

Debt is never an investment in the future, no

matter how eloquently stated, or how firmly the

belief is held. Instead, debt resembles a giant pok-

er game bet with all moves predicated on future

performance.

Download to read all

CONSUMER CAUTION!

Review your debit, credit card statements, a mort-

gage statement if you have bought a home, auto

loans, equity lines, and don’t forget personal debt

payments to friends and family.

The difference between debit and

credit cards is huge!

Debit cards deduct the charge immediately

from your bank account using your money.

Credit cards let you borrow other people’s

money (banks) and for that privilege, these

generous people (well that is what we want to

think) are going to charge for the use of their

money.

They are never in the business of lending for free!

Download to read all

Tracking Your Employee Benefits in Bermuda

Bermuda Employment Laws, Benefits and Rights

Keeping an eye on your paycheque deductions

and employer-employee benefit responsibilities.

Your budget process is not just comprised of

checking your income and expenses relative to

your bank transactions / statements.

You should routinely review your paycheque, the

net amount deposited in your bank account, and

whether the deductions and benefits that you are

entitled to are math correct and have been de-

posited by your employer on your behalf!

Download to read all

This phase of your financial review may be bit

more tedious for some, but it is also the most im-

portant, so we will cover it in steps Ten - Thirteen.

We will review

A. Why invest at all in capital markets?

B. Investment basics - just a few

C. A quick look at a hypothetical small Bermuda

business start-up relating to stock ownership

(a more complete picture leading to Book Two

is featured in the Appendix A);

D. Assess, in general, your personal investment

holdings and asset allocations, if you own any;

E. Show the characteristics of a balanced portfo-

lio if you want to own investments outside of

your pension.

Download to read all

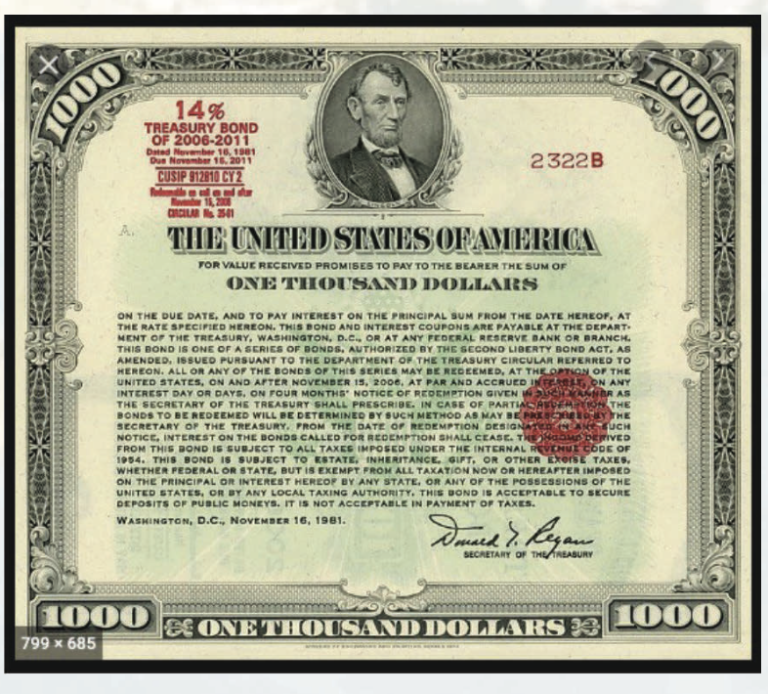

Bonds Are Debt, Not Equities

Bonds are debt, a much more sophisticated form of a loan

legalised into a security that can be publicly traded.

Bond investors (you) never own any part of a company - you are just a creditor. You have no ownership stake, no long-term appreciation, but if you hold a high-grade bond to maturity,

while not guaranteed, you will receive the principal back.

United States 30-year bond certificate issued November 16, 1981 at 14% coupon interest rate and $1000 Face Value with a maturity date of November 15, 2011.

MAMA Zina's Pizzarina: A Bermuda Islander Start-up Business - in Their Home Kitchen

Why Invest?

And in what?

How does an investment arise?

Our Hypothetical Bermuda Island family story will illustrate how they home-grew a business creation, that ultimately was formalised legally as a private corporation with each family member owning a percentage of the stock issued.

It May Possibly be Your Largest Investment Asset

Here is a little factoid.

Your Bermuda National Pension Plan (formal

name Occupational Pensions Act 1998) is probably going to be your biggest asset, besides your home.

Spectacularly, a 25 -year old in the Bermuda private business workforce today could see

values at retirement even higher than the value of

his/her home.

Further, I can assure you that if you understand what is in your pension plan, you will feel more comfortable about other investments you might want to make on your own.

This assumes that you make it a personal consistent goal

to monitor your pension plan on a quarterly basis.

THIS is your money!

Download to read all

We are now at the process to review the performance of a illustrative selected pension account:

A. Monitoring the performance of a balanced

pension fund;

B. Discuss Lifestage differences in allocations and rates of return for conservative, balanced and aggressive portfolio relative to your age and years of employment in the workforce;

C. Comparing your investment drawdown account versus the annuity pension choice;

D. Walk-through a couple of different retirement calculators to project some possible estimated amounts to expect for retirement.

Download to read all!

Your review plan is almost finished - don’t give up now.

If Time is On Your Side, Think Long-Term

Do yourself a favour.

Think long-term, always with the exception of the

close-to-retirement individuals.

Be willing to be a little more investment aggressive when you are younger, then, tapering off as you age, accumulate other savings and investments, your first home, an individual investment

account.

Why? Because time is on your side.

Do not focus on short term investing results. Further, there have been numerous market volatility episodes as well as capital market crashes. Each and every time, markets have recovered from loss positions, and moved forward into positive territory.

Download to read all!

Managing Risk, Consequences and Resolution

Everyone faces risks and anxieties at some point in their lives, from job security to relationships, health issues, natural disasters, financial uncertainty and the like.

Knowing how these all can occur and managing them is important to a having a secure handling of your finances.

The risk of living.

We live with fear, worry, and risk every day. We don’t think we do, but risk of losing some component of our being is there as a completely random event or within our control to manage and

prevent.

Download to read all!

Estate Planning for Your Family & Legacy

Have we put our affairs in order?

Managing the finances of a single individual is a challenge any day of the week. Imagine how complex it can be when a nuclear family or several generations come into play. Some of the stressors

that occur within family circles are the very ones that could be avoided by putting simple, easily understood estate planning into place, early.

The Pitfalls and Pain from ‘Forgetting’ to Plan.

We are all creatures of habit. Many of us find it extremely difficult at the end of the day to take care of financial tasks, so we don’t; they just get put off, sometimes inevitably never.

Download to read all!

Nothing Zero About Tax in Bermuda’s Economy!

All governments across the globe assess some sort of taxes in order to operate a country, if you will. Some countries do have low tax rates - due to high valuations from native and natural products, such as sheer volumes of oil supplies to the world - that have the effect of reducing the need for taxation from the local populace to almost nil.

Most countries, however, assess taxation in one form or another on their residents and citizens.

Bermuda is no exception, having just as many taxes as other jurisdictions, working out to a marginal tax rate of an average 22% of GDP (Gross Domestic Product).

Our domestic taxes are not based upon progressive incomes; consequently, those families in the lower earnings brackets are much harder hit than the more upwardly mobile.

Download to read all!

Your Bermuda Back-2-Basics Financial Review

is Over.

You’ve reached the Lightness of Being - in Financial Control of your finances, in our unique Bermuda financial environment.

Bermuda’s Coat-of-Arms is Quo Fata Ferunt, meaning wherever the Fates will Lead Us.

You do not embrace that motto. You be in control of your financial destiny!

This is the final step of a long, hopefully exciting, illuminating review of all of your Bermuda financial resources in order to improve your financial Lifestyle.

Did you do it?

Congratulations. You’ve run the course - gone through frustration, boredom, and lack of confidence, now you are just about at the end.

Download to read all!

A Pondstraddler is a person with one foot on each shore whose heart resides in both countries.

Bermuda Residents are Perennial Pondstraddlers, so many of us have International Connections. We have uniquely sophisticated lifestyles.

For more than 400 years, Bermuda residents have been habitual border crossers. You can label us “puddle-jumpers” “Pond- straddlers”, “nomads,” “global explorers” - the fact remains that there is no unequivocal choice.

Almost everyone in Bermuda must travel elsewhere, building family & personal relationships, investments, business and links of all sorts to countries with different regulations and tax regimes.

Cross Border Financial Planning, Taxation and Compliance Challenges are ever present.

Download to read all!

Readers often write to me about my more than 1500 financial column topics and how my answers and resource links have helped them find answers to their finance questions.

I am incredibly appreciative, and thank you all, every single one of you who has taken time from your busy lives to contact me.

These special comments are hugely motivating to me to provide as factually, and comprehensively as possible, more financial information relevant to Bermuda islanders’ lives.

Our geographical location and our polyglot of nationalities, citizenships, domiciles, family, cultures, and residency ties means that we have to be cognisant of the financial constraints, requirements, reporting, and regulations of not just our domestic regime, but also those countries closest to us that trade with us: US, United Kingdom, Canada and elsewhere!

These websites/resources are chock full of information, which will almostalways require research and digging to find your personal answers. Note also, that I do not receive (or pay) compensation, from any agency or individual for my work or these listings.

Download to read all!

A Pondstraddler is a person with one foot on each shore whose heart resides in both countries.

Bermuda Residents are Perennial Pondstraddlers, so many of us have International Connections. We have uniquely sophisticated lifestyles.

For more than 400 years, Bermuda residents have been habitual border crossers. You can label us “puddle-jumpers” “Pond- straddlers”, “nomads,” “global explorers” - the fact remains that there is no unequivocal choice.

Almost everyone in Bermuda must travel elsewhere, building family & personal relationships, investments, business and links of all sorts to countries with different regulations and tax regimes.

Cross Border Financial Planning, Taxation and Compliance Challenges are ever present.

Download to read all!

Comments or Questions? contact@marthaharrismyron.org

©2024 Martha Harris Myron Bermuda PondStraddler Finance Media All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.