About Martha Harris Myron

I’m a former qualified international financial planning professional, investment advisor, a retired United States licensed CPA-Certified Public Accountant-NH1929,

CFP® Certified Financial Planner,

TEP Trust & Estate Practitioner (UK/Bermuda),

holding a Master of Science in Laws in International Taxation and Financial Services, Summa Cum Laude

Financial Literacy Learning Mission

My full-time focus now is devoted to financial literacy for Bermuda (and internationally) as author, financial journalist (25 years +) for Bermuda's national newspapers and various other publications, e.g. Google News as well as presenter, blogger, videographer, podcaster, and YouTube Channel Creator

I am endlessly interested in the world of finance and how people manage their daily financial life.

Growing up in remote Bermuda, cutoff from the outside world, was an entirely different existence. With little communication infrastructure at the time, no television access, costly limited movie and telephone availability, reliance upon importation for almost every basic sustenance, one learned very early on self-sufficiency, big-picture thinking and reliance on one's own instinctive ingenuity in decision making.

It was truly an idyllic time of childhood surrounded by the sparkling seas, dazzling light, endless sunshiny days with time for dreaming and creativity.

Navigating our complex finance world can be costly - in time, energy and complications. The onset of artificial intelligence has increased financial complexity.

Relentless criminal schemes to ruin your financial security are on the rise.

Ongoing financial knowledge is an absolutely critical requirement to protect your finances and your very identity.

Thus, financial literacy is my mission and commitment to my beloved island and all Bermuda islanders who reside within and without - we are after all relentless world travelers - needing unbiased financial information and resources in order to make the best financial decisions possible for ourselves and our families.

I write extensively for the Bermuda and international community and their multi-national connections, illuminating all things financial relative to Bermuda, utilising my long-tailed professional background (as both a native Bermudian and a United States qualified finance professional) while pondstraddling both jurisdictions. My primary focus is on individuals and their families in international & domestic investments, insurance, retirement, taxation, legacy, money management/digital currency, cross border financial planning, and related economic focus areas.

BACKGROUND

As a native Bermuda-born national, I'm also a multinational - pondstraddler- citizen of Bermuda, United States, and the United Kingdom. My working career (50% in each jurisdiction) encompassed varied fields: medical technology, garment/fabric design, real estate & construction development, accountancy, and in the tax, finance, and investment industries, both in the United States and internationally in Bermuda, my island home.

Raised on our remote island of Bermuda at a time of tourist filled activity, and parochial economics, all filtered with quiet, picturesque, elegant, and sun-filled sea-sparkling charm, my indigenous Bermuda background and personal experiences as a perennial pondstraddler between Bermuda, UK, and the United States have given me a unique perspective on the challenging financial environment for local and international residents and their families living, working in Bermuda and connected across the Great Atlantic Pond between the border points: United States, Canada, United Kingdom, Caribbean, and Bermuda, the premier international financial jurisdiction.

All proceeds from any presentations, publications, webinars, podcasts, etc. are donated to Bermuda registered charities

PRESENTATIONS

For information on free financial planning presentations to your group or company, please contact me via email martha.myron@gmail.com

I do not accept gratuities but only ask if you wish that an anonymous donation be made to your Bermuda charity of choice),

Creating Value in Later Life: A Conversation with Martha Harris Myron

by Robin Trimingham, 10 February 2021 of RGMAGBDA.

Photo: The Harris family home 1947, Spanish Point. Bermuda.

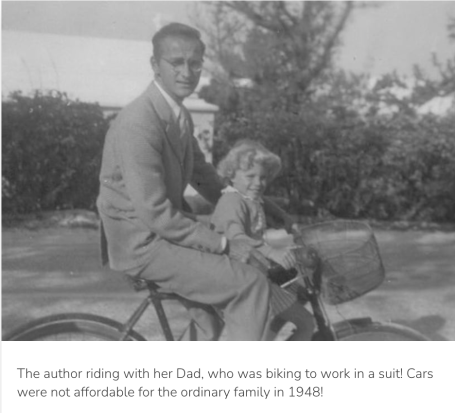

Long-time financial columnist Martha Harris Myron is no stranger to the need to be frugal. Born in Bermuda, her father operated a sewing machine sales and repair business on Wesley Street during a time when many families struggled to make ends meet. Her upbringing instilled in her a lifelong sense of the importance of counting every penny and value of planning for your long-term health and financial future as early as possible.

Moving to New England to live with her grandmother at the age of sixteen afforded Martha the opportunity to study medical technology and an internship at Tufts-New England Medical Center in Boston. Her eclectic career path has also included working in garment design and the construction industry before finally obtaining a degree in accounting and a Master of Law degree once her own children had completed college.

It was then that she embarked on a career as an international professional finance consultant to Bermuda residents, advising both their multinational families and businesses on cross-border financial planning; ultimately specializing in assisting with the unique financial challenges for international citizens living, working, and straddling what she refers to as “The North Atlantic pond” (the territory comprising the United States, Canada, United Kingdom, Europe, and the island of Bermuda).

It’s no wonder then that Martha’s no-nonsense approach to personal financial management makes her twenty-year financial column with the Royal Gazette an enduring success because she has lived through five major recessions and appreciates exactly what it takes to recover from setbacks in a complex financial jurisdiction.

“Bermuda does not have an independent financial planning website like Yahoo Finance. There’s a huge need for a place for people to obtain trustable financial facts to help them make financial decisions without trying to sell product,” she says.

Now in her seventies, Martha’s days are busier than ever.

In addition to writing her weekly column, she has recently released her first digital format book entitled “The Bermuda Islander Fundamental Financial Planning Primer”. This book, which is the first in a series of seven that she has planned, focuses primarily on personal financial matters for island residents – and future titles will include information and topics ranging from risk and insurance, to investments.

She is also in the midst of recording a series of “Fast Fact” audio tracks to accompany the various segments of her eBook on The Royal Gazette and is looking forward to participating as a regular panellist on a new video series entitled “Leaders in Action – Looking Ahead” which is being produced by Olderhood Productions International to air on social media around the world.

When asked if she had any thoughts of slowing down, she laughed and confided that the secret to a fulfilling later life is to find something that you are interested in that promotes your own sense of purpose and identity and enables you to continue to contribute to society.

In Martha’s mind, planning for your financial future requires taking a good hard look at a lot more than your bank balance. “Many people don’t have a sense of purpose when they leave work, and this frequently leads to unhappiness, marital discord, and spending money excessively or inappropriately.” In fact, given that older people still have so much to offer, she questions whether many people should really retire at all.

“I really don’t think this later phase of life should be called retirement at all,” she said. “People really need to start planning what they are going to do next at least 3-4 years before they leave their current job. It’s essential to figure out what you can do either part-time or full time to maintain a sense of personal value.”

Rather than think about retirement, Martha advises, “Just think of this as another change in your journey; and if you really are going to retire make sure you practice first – practice how you will live, what you will do, and experience how it will feel to either spend time with your spouse 24 hours a day, or how it will feel to be alone all the time depending on your circumstances.”

Our later years can be lengthy, so having a purpose in life is essential, and while it can change over time, it is the bedrock of our later years. Every individual is different in many respects – we have our own individual standards and character. Moreover, the things we enjoyed when we were younger may not hold the same appeal as we age. What we planned to do in our later years can change – due to not enough money, not enough energy – or simply because our goals have changed.

Finding purpose in life is something to plan ahead of time and continually review and revise, as necessary. “And above all, make sure you realize that later life is not just about money – the key to a long and prosperous retirement is to stay connected and stay involved.”

Smiles all Around, Martha Harris Myron :)

Comments or Questions? contact@marthaharrismyron.org

©2024 Martha Harris Myron Bermuda PondStraddler Finance Media All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.